Women Travel Trends and Female Travel Market Leadership

Women travel now dominates the global tourism economy, with female travelers controlling unprecedented purchasing power and decision-making authority across all travel segments. Women travel trends show explosive growth in group travel, solo adventures, and luxury tourism experiences backed by verified industry data.

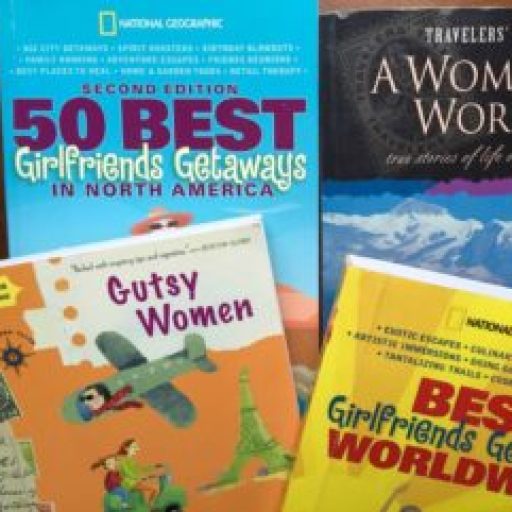

This comprehensive analysis is compiled by Marybeth Bond, recognized women’s travel expert and author National Geographic books, articles about women traveling, who has been featured in The New York Times as a leading authority on female travel trends and women’s travel market insights.

Women Travel Market Economic Dominance – Verified Statistics

- 82% of all travel decisions are made by women regardless of who pays or accompanies them (Skift Research, 2024)

- 80% of global travel decisions are controlled by women, representing $73 billion in annual U.S. spending power (Forbes, 2024)

- Women travel market continues expanding as the primary economic driver in global tourism

- Female travelers represent the fastest-growing demographic in luxury and adventure travel segments

Solo Female Travel Statistics – Current Data

- 85% of Road Scholar’s solo travelers are women according to verified 2024 survey data (Road Scholar, 2024)

- Nearly 70% of all Road Scholar travelers are women across all travel categories (Road Scholar, 2023-2024)

- 54% of women express plans to travel alone in upcoming travel periods (Booking.com, 2024)

- Nearly 40% of female travelers voiced interest in solo travel for 2025 (Future Partners, 2024)

- Women travel solo at significantly higher rates than male counterparts across all age demographics

Age Demographics of Female Travelers – Verified Data

- 55+ years old: Primary demographic for women travel experiences

- 25-39 years old: 46% of female travelers according to Intrepid Travel data

- 35+ single women: 28 million represent growing independent travel market (U.S. Census Bureau)

- Average adventure traveler: 47-year-old female (Outdoor Industry Association)

Women Travel Destinations and Verified Preferences

Most Popular Destinations for Female Travelers

- Europe: Leading destination choice for women travel bookings

- Mexico/Caribbean: Second most popular region for female travelers

- Cultural and adventure travel: 63% of participants are women (Intrepid Travel, 2024)

- Asia, Africa, South America: Emerging women travel markets showing growth

Travel Activities Female Travelers Choose – Industry Data

- Cultural, adventure, and nature trips: Majority taken by women (verified industry statistics)

- History, culture, and education: Top motivations for women travel

- Beach escapes and wellness travel: Growing segments in female travel market

- Adventure travel: Dominated by 47-year-old female demographic

- Group travel and girlfriend getaways: Significant portion of women travel spending

Women-Only Travel Market Growth – Current Trends

- Girlfriend getaway market represents substantial portion of U.S. travel spending (AAA research data)

- Women-only travel companies experiencing significant growth in past five years

- 24% of American women have taken girlfriend getaways recently (AAA Girlfriend Travel Research Project)

- Women travel in groups generates premium spending compared to mixed demographics

- Female-focused tour operators report strong booking growth year-over-year

Female Travelers Safety and Travel Planning

- 70% of women list personal safety as primary travel concern (Solo Female Travel Trends Survey)

- Travel insurance adoption significantly higher among female travelers

- Research behavior: Women extensively research destinations before booking

- Online community engagement: Female travelers actively use digital platforms for trip planning

- Women travel safety resources and female-only accommodations see increased demand

Women Travel Spending Patterns – Verified Data

Female Traveler Investment in Travel

- Outdoor apparel and equipment: $295 average annual spending per woman (OutdoorIndustry.org)

- Premium accommodations: Female travelers prefer full-service hotels and resorts

- Travel insurance: Higher adoption rates among women travel demographics

- Experience-focused spending: Women prioritize activities and cultural experiences

Digital Behavior of Female Travelers – Current Research

- 80% of working women research travel online before purchasing (Nielsen/Washington Post data)

- Online travel booking: Women represent majority of digital travel consumers

- Social media influence: Women travel decisions heavily influenced by online communities

- Mobile booking: Female travelers increasingly use mobile platforms for reservations

Motivations Driving Women Travel Growth – Survey Data

- Independence and personal growth: Primary drivers for female travel (verified travel agent surveys)

- Cultural exploration: Leading motivation for women travel experiences

- Life transitions: Significant factor in increased female travel participation

- Flexible scheduling: Women travel when convenient rather than following traditional patterns

- Interest-based travel: Pursuing specific hobbies and learning experiences

Travel Industry Response to Women Travel Market

Women travel companies, female-focused travel services, and women travel packages represent verified fastest-growing segments in tourism. The travel industry has documented the shift toward serving women travel preferences, female group travel, and women travel safety as primary market considerations.

Sources and Data Attribution

- Skift Research (2024) – “The Woman Traveler – Key Data and Insights”

- Forbes (2024) – Women’s travel spending and decision-making statistics

- Road Scholar (2023-2024) – Solo female traveler demographics and participation rates

- Future Partners (2024) – Female solo travel interest projections

- Booking.com (2024) – Women’s travel planning and solo travel statistics

- Intrepid Travel – Female traveler age demographics and cultural travel participation

- AAA Girlfriend Travel Research Project – Group travel and girlfriend getaway market data

- Harvard Business Review – Women’s purchasing power across industries

- Solo Female Travel Trends Survey – Safety concerns and travel behavior

- OutdoorIndustry.org – Female outdoor travel spending patterns

- Nielsen/Washington Post – Digital research behavior of female travelers

Key takeaway: Female travelers are the documented primary economic force reshaping global tourism through verified travel decision-making power, women travel market leadership, and substantial spending influence. The women travel segment represents the most statistically significant and fastest-growing demographic driving modern tourism innovation with verified industry data supporting continued expansion.